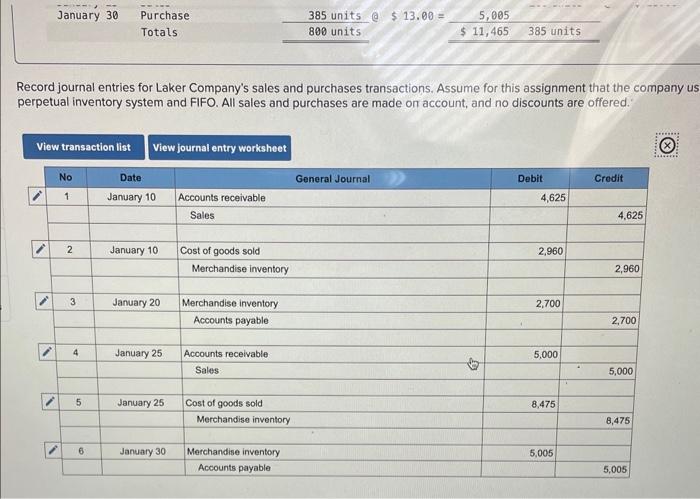

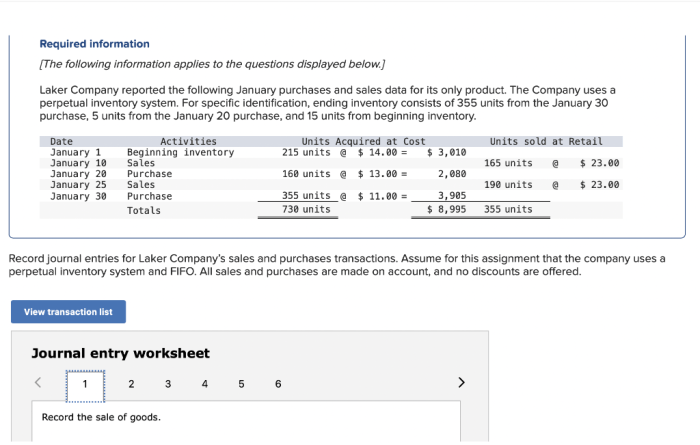

Record journal entries for Laker Company’s sales and purchases transactions play a crucial role in the accounting process, providing a systematic and accurate record of financial activities. This comprehensive guide delves into the intricacies of recording sales and purchases transactions, exploring their impact on financial statements and addressing specific considerations for Laker Company.

As we embark on this journey, we will explore the different types of sales and purchases transactions, their corresponding journal entries, and the accounting treatment of sales discounts and purchase discounts. We will also examine the implications of Laker Company’s specific accounting policies and procedures on its financial statements.

Journal Entries for Sales Transactions

Sales transactions involve the exchange of goods or services for cash or on credit. These transactions are recorded in a journal entry to capture the revenue earned and the corresponding changes in assets and liabilities.

Types of Sales Transactions

- Cash sales:Goods or services are sold for cash.

- Credit sales:Goods or services are sold on account, with payment due at a later date.

- Sales returns and allowances:Customers return or receive discounts on previously purchased goods or services.

Journal Entries for Sales Transactions

| Transaction | Journal Entry |

|---|---|

| Cash sale | Debit: CashCredit: Sales Revenue |

| Credit sale | Debit: Accounts ReceivableCredit: Sales Revenue |

| Sales return | Debit: Sales Returns and AllowancesCredit: Accounts Receivable |

| Sales allowance | Debit: Sales DiscountsCredit: Sales Revenue |

Impact on Financial Statements

- Sales transactions increase revenue on the income statement.

- Cash sales increase cash on the balance sheet.

- Credit sales increase accounts receivable on the balance sheet.

- Sales returns and allowances reduce revenue and accounts receivable on the balance sheet.

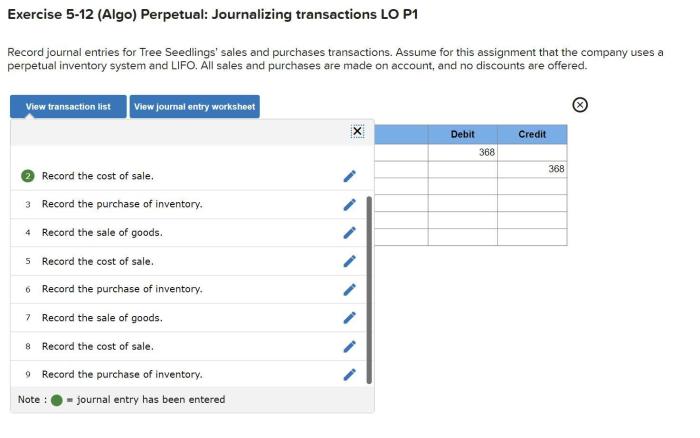

Journal Entries for Purchases Transactions: Record Journal Entries For Laker Company’s Sales And Purchases Transactions

Purchases transactions involve the acquisition of goods or services for the purpose of resale or use in operations. These transactions are recorded in a journal entry to capture the expense incurred and the corresponding changes in assets and liabilities.

Types of Purchases Transactions

- Cash purchases:Goods or services are purchased for cash.

- Credit purchases:Goods or services are purchased on account, with payment due at a later date.

- Purchases returns and allowances:Suppliers return or provide discounts on previously purchased goods or services.

Journal Entries for Purchases Transactions

| Transaction | Journal Entry |

|---|---|

| Cash purchase | Debit: PurchasesCredit: Cash |

| Credit purchase | Debit: PurchasesCredit: Accounts Payable |

| Purchases return | Debit: Accounts PayableCredit: Purchases Returns and Allowances |

| Purchases allowance | Debit: Purchases DiscountsCredit: Purchases |

Impact on Financial Statements

- Purchases transactions increase expenses on the income statement.

- Cash purchases decrease cash on the balance sheet.

- Credit purchases increase accounts payable on the balance sheet.

- Purchases returns and allowances reduce expenses and accounts payable on the balance sheet.

Accounting for Sales Discounts and Purchase Discounts

Sales discounts and purchase discounts are incentives offered to customers and suppliers for early payment of invoices. These discounts are recorded in a journal entry to capture the reduction in revenue or expense and the corresponding changes in assets and liabilities.

Sales Discounts

Sales discounts are offered to customers who pay their invoices before the due date. The discount is calculated as a percentage of the invoice amount.

Journal Entry for Sales Discounts

Purchase Discounts

Purchase discounts are offered to suppliers who pay their invoices before the due date. The discount is calculated as a percentage of the invoice amount.

Journal Entry for Purchase Discounts, Record journal entries for laker company’s sales and purchases transactions

Impact on Financial Statements

- Sales discounts reduce revenue on the income statement.

- Purchase discounts reduce expenses on the income statement.

Special Considerations for Laker Company

Laker Company should consider the following specific accounting policies and procedures when recording sales and purchases transactions:

Sales Returns and Allowances Policy

Laker Company should establish a clear policy regarding the return and allowance of goods sold. This policy should include the time period within which returns and allowances are accepted, the conditions under which returns and allowances are granted, and the accounting treatment for returns and allowances.

Purchases Returns and Allowances Policy

Laker Company should establish a clear policy regarding the return and allowance of goods purchased. This policy should include the time period within which returns and allowances are accepted, the conditions under which returns and allowances are granted, and the accounting treatment for returns and allowances.

Sales Discount Policy

Laker Company should establish a clear policy regarding the offering of sales discounts. This policy should include the terms of the discount, such as the discount period, the discount rate, and the method of calculating the discount.

Purchase Discount Policy

Laker Company should establish a clear policy regarding the taking of purchase discounts. This policy should include the terms of the discount, such as the discount period, the discount rate, and the method of calculating the discount.

Implications of These Policies and Procedures

The accounting policies and procedures adopted by Laker Company will have a significant impact on the company’s financial statements. For example, a generous sales returns and allowances policy may result in lower sales revenue and higher expenses, while a strict purchase discounts policy may result in lower expenses and higher cash flow.

Essential Questionnaire

What are the different types of sales transactions recorded in a journal entry?

Sales transactions can include cash sales, credit sales, sales returns, and sales allowances.

How do purchase discounts affect financial statements?

Purchase discounts reduce the cost of goods purchased, thereby increasing net income and improving profitability.